cook county back taxes

The Cook County property tax system is complex. Get the Help You Need from Top Tax Relief Companies.

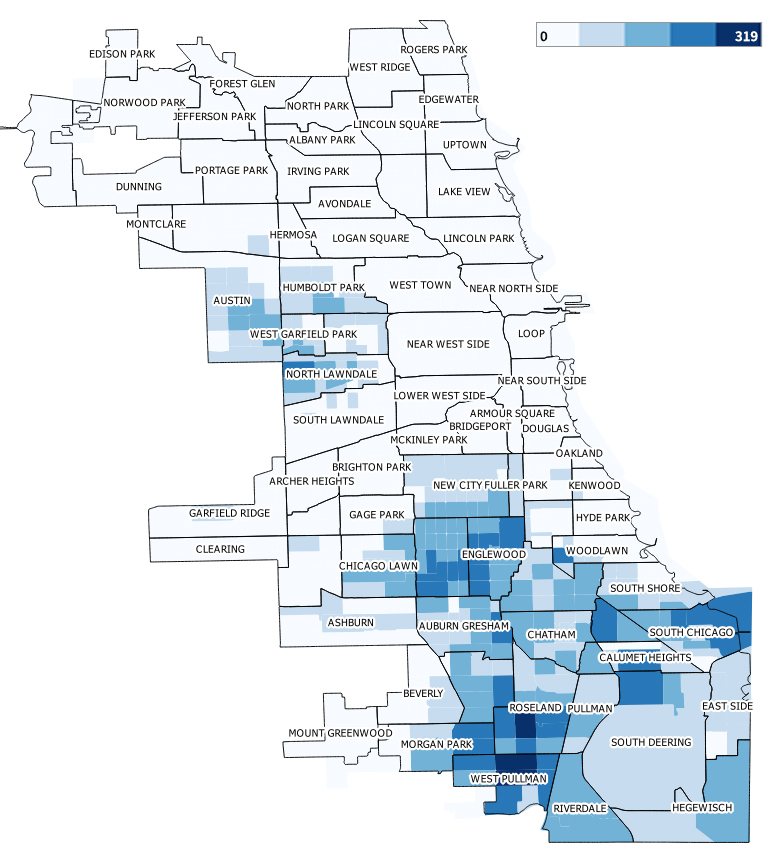

Cook County Treasurer Maria Pappas Wants To Help Black Homeowners Who Could Lose Houses To Unpaid Property Taxes Abc7 Chicago

In this section we explain all of it.

. Ad Find Out the Market Value of Any Property and Past Sale Prices. The county sued sams club in 2019 for failure to comply with its tobacco tax ordinance. Since the CCLBA is the government entity taking these properties to deed the buyer will not have to pay the back taxes on the property.

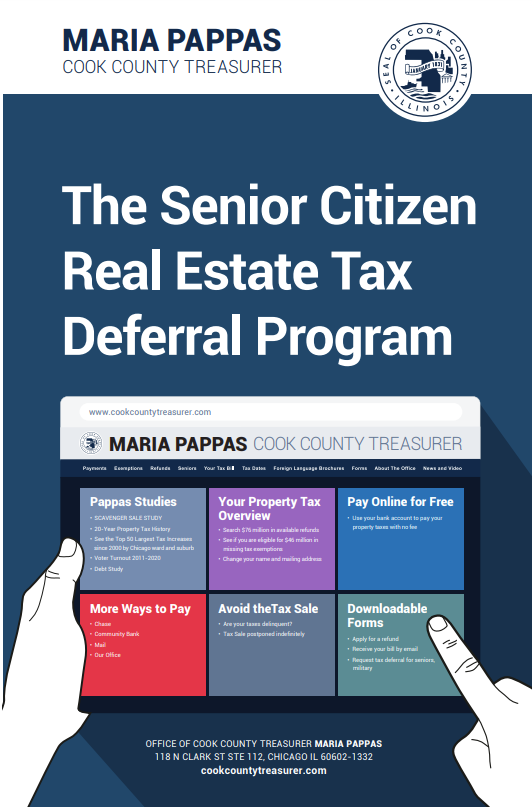

COOK COUNTY TREASURER Payments Exemptions Refunds Seniors. Any payments made on or before October 1 for property tax second installments will be considered filed and paid on time by Cook County Treasurer Maria Pappas. Cook County Treasurers Office - Chicago Illinois.

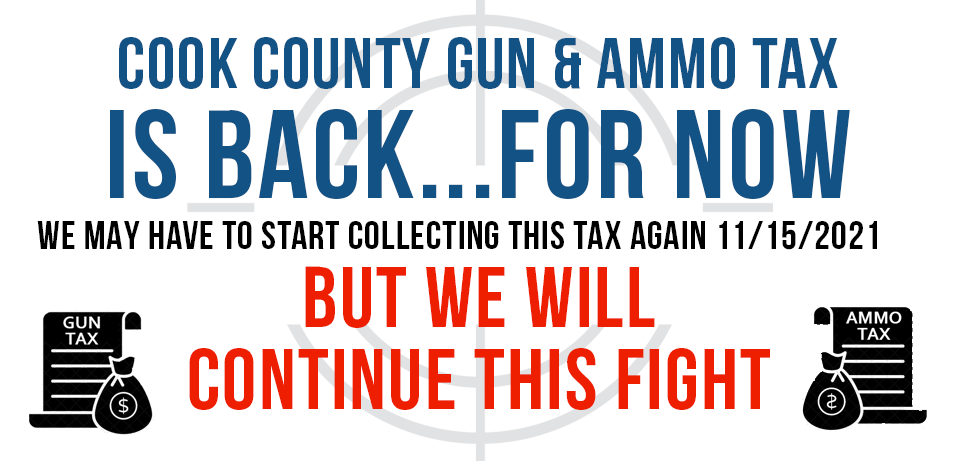

What is a property tax foreclosure. To pay your Property Taxes please click below to be taken to the website of the Cook County. Cook County guns and ammo tax struck down by Illinois Supreme Court is back on the books for now after Thursday board vote.

When that happens the unpaid taxes on these parcels are offered at an annual tax sale where the general public has the option to. Billed Amounts Tax History. Tax Year 2020 Tax Bill Analysis.

The 2021 tax year exemption applications are now available. Cook County Clerk issues tax certificate to tax buyer and takes responsibility for process going forward regarding property owner redemption and interaction with tax buyer to acquire tax deed 10. Plus the Illinois Department of Revenue.

Our office has collected every delinquent property and included in the below spreadsheet. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. 20-Year Property Tax History.

It involves the Assessors Office the Board of Review the Cook County Clerk and the Cook County Treasurer. Every year your county collects state and local taxes based on the value of your home or land property. Search to see a 5-year history of the original tax amounts billed for a PIN.

Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. The Cook County Land Bank Authority CCLBA will offer for below-market sale long-vacant properties throughout suburban Cook County and the City of Chicago focusing on community redevelopment. The Cook County Clerks office has a variety of property tax responsibilities.

Select a tab for detailed lists of properties with delinquent taxes for Tax Year 2019 payable in 2020 that are currently eligible for the Annual Tax Sale that begins May 12 2022. Even if you are only one day late with your tax payment you will have to pay the balance due plus a penalty of 15 interest per month. Cook County Assessor Fritz Kaegi has slashed their property tax breaks and is going after seven of them for 371000 in back taxes he says they should have paid.

Under the proposed relief ordinance interest penalties for late payments of the second installment of property taxes which are normally due August 3 will now be postponed until October 1. Cook county scavenger sale On an annual basis Cook County has a number of parcels where the taxes are delinquent. See the Top 50 Largest Tax Increases since 2000 by Chicago ward and suburb.

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. As a reminder many exemptions automatically renew this year due to COVID-19. October 13 2020 1202 PM.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Cook County IL at tax lien auctions or online distressed asset sales. When delinquent or unpaid taxes are sold by the Cook County Treasurers office the Clerks office handles the redemption process which allows taxpayers to redeem or pay their taxes to remove the risk of losing their property. The Cook County Treasurers Office provides payment status for current tax years and the ability to pay online.

When delinquent or unpaid taxes are sold by the cook county treasurers office at an annual sale or scavenger sale the clerks office can provide you with an estimate cost of redemption detailing the amount necessary to redeem pay your taxes and remove the threat of losing your property. Each county has a specific. Struggling hotels malls owe Cook County millions in back taxes More than 500M remains outstanding after Oct.

Records for delinquent taxes for prior years currently defined as tax year. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment. Once you search by PIN you can pay your current bill online or learn additional ways to pay by clicking More Tax Bill Information on the next page.

What happens if you owe delinquent property taxes. Landlords Blackstone Simon included owe Cook County big in back taxes Firms are short total of nearly 200M in property taxes from 2019 and over 1B from 2020. 1 extended deadline passed.

The Cook County Treasurers office says thousands of people are owed property tax refunds and its as simple as entering your address on the treasurers website. You Dont Have to Face the IRS Alone. ANNUAL TAX SALE - ONLINE.

Assessor Fritz Kaegi announces that property-tax-saving exemptions for the 2021 tax year are now available online in a new streamlined application. Cook County Property Tax Sale List Every year the Cook County Treasurers Office is required to conduct an annual tax sale and biennial scavenger sale of delinquent PINS and parcels. How much you pay in taxes depends on your propertys assessment assessments of other properties appeals exemptions and local tax levies.

The Morning Insiders had no idea. If you are unable to pay your property taxes the county can sell your home to collect all unpaid property taxes. Cook County IL currently has 38064 tax liens available as of April 12.

Cook County charges property taxes annually.

Cook County Gun Ammo Tax May Be Back Soon

Cook County Property Tax Bill How To Read Kensington Chicago

Covid 19 Faq Cook County Assessor S Office

Senior Citizen Real Estate Tax Deferral Program Cook County Assessor S Office

Cook County Property Tax Bills May Be Delayed By Inter Office Controversy Abc7 Chicago

Cook County Treasurer S Office Chicago Illinois

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr

Column Property Tax Collection Data Show The Usual Suspects Are Lagging In Cook County Chicago Tribune

What Cook County Township Am I In Kensington Research

Cook County Property Tax Sale To Be Held In November Treasurer Maria Pappas Announces Abc7 Chicago

Cook County Treasurer Maria Pappas Abc7 Chicago Host Black And Latino Homes Matter Phone Bank For Property Taxes Refunds Abc7 Chicago

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr

Cook County Property Tax Bills In The Mail This Week

Your 2020 Cook County Tax Bill Questions Answered Medium

Your 2020 Cook County Tax Bill Questions Answered Medium

Cook County Board Of Review Residential Property Tax Appeals Period Open Until February 1 2022

Cook County Property Tax Sale To Be Held In November Treasurer Maria Pappas Announces Abc7 Chicago

Cook County Triennial Property Tax Assessment Schedule Kensington